[ad_1]

Archives

(PRELIMS + MAINS FOCUS)

Financial Inclusion index

Part of: GS Prelims and GS- III – Economy

In news The Reserve Bank of India (RBI) announced the formation of a composite Financial Inclusion Index (FI-Index) to capture the extent of financial inclusion across the country.

- The FI-Index for the period ended March 2021 stood at 53.9 compared with 43.4 for the period ended March 2017.

About Financial Inclusion Index

- Annual Financial Inclusion Index (FII) will measure access and usage of a basket of formal financial products and services that includes savings, remittances, credit, insurance and pension products.

- It would rate states on their performance on last-mile banking services availability.

- The index will have three measurement dimensions

- access to financial services

- usage of financial services

- the quality of the products and the service delivery.

- These are also the G20 Financial Inclusion Indicators.

- It will be published in July every year by RBI.

-

- Provide information on the level of financial inclusion.

- Measure financial services for use of internal policy making.

- It can be used directly as a composite measure in development indicators.

- It enables fulfilment of G20 Financial Inclusion Indicators requirements.

- It will also facilitate researchers to study the impact of financial inclusion and other macro-economic variables.

News Source: TH

Tejas Light Combat Aircraft (LCA) Mk-1A

Part of: GS Prelims and GS- III – Defence and Security

In news Hindustan Aeronautics Limited (HAL) on Tuesday signed a $716-mn deal with GE Aviation of the U.S. for 99 F404 aircraft engines and support services that will power the indigenous Tejas Light Combat Aircraft (LCA) Mk-1A.

- In February, the Defence Ministry had signed a Rs. 48,000 crore deal with HAL to supply 83 LCA-Mk1A to the Indian Air Force.

- The Light Combat Aircraft Tejas is an indigenous supersonic fighter-jet used by the Indian military.

About Light Combat Aircraft Tejas

- LCA Tejas is a single-engine multirole light combat aircraft.

- The Light Combat Aircraft (LCA) programme was started by the Government of India in 1984 when they established the Aeronautical Development Agency (ADA) to manage the LCA programme.

- LCA Tejas was designed and developed by India’s HAL (Hindustan Aeronautics Limited).

- It replaced the ageing Mig 21 fighter planes.

- It is the second supersonic fighter jet that was developed by HAL (the first one being HAL HF-24 Marut).

- It is the lightest and smallest multi-role supersonic fighter aircraft in its class.

- It is designed to carry a range of air-to-air, air-to-surface, precision-guided, and standoff weaponry.

About Tejas LCA Mk.1A

- Light Combat Aircraft Mk-1A variant is an indigenously designed, developed and manufactured state-of-the-art modern 4+ generation fighter aircraft.

- Tejas LCA Mk-1A will be superior over previous variants of LCA Tejas, in terms of avionics, performance, and weapons capabilities.

- This aircraft is equipped with critical operational capabilities of Active Electronically Scanned Array (AESA) Radar, Beyond Visual Range (BVR) Missile, Electronic Warfare (EW) Suite and Air to Air Refuelling (AAR).

- LCA Tejas Mk-1A will be flexible enough for hardware and software integration that would be required to fire different types of Beyond Visual Range (BVR), which are available in the inventory of the Indian Air Force (IAF).

- It is the first “Buy (Indian-Indigenously Designed, Developed and Manufactured)” category procurement of combat aircrafts with an indigenous content of 50% which will progressively reach 60% by the end of the programme.

News Source: TH

National Commission for Minorities

Part of: Prelims and GS – II – Issues related to minorities

In news Recently, the Delhi High Court directed the Centre to nominate persons to all the vacant positions in the National Commission for Minorities (NCM) by 30th September, 2021.

- This is to ensure that the commission functions efficiently and the purpose of the commission as envisaged under the National Commission for Minorities Act (NCM), 1992 is also fully given effect to.

What is the background of NCM?

- In 1978, setting up of the Minorities Commission (MC) was envisaged in the Ministry of Home Affairs Resolution.

- In 1984, the MC was detached from the Ministry of Home Affairs and placed under the newly created Ministry of Welfare.

- The MC became a statutory body and was renamed as the NCM in 1992, with the enactment of the NCM Act, 1992.

- In 1993, the first Statutory National Commission was set up and five religious communities viz. The Muslims, Christians, Sikhs, Buddhists and Zoroastrians (Parsis) were notified as minority communities.

- In 2014, Jains were also notified as a minority community.

What is the composition of NCM?

- NCM consists of a Chairperson, a Vice-Chairperson and five members and all of them shall be from amongst the minority communities.

- Total of 7 persons to be nominated by the Central Government should be from amongst persons of eminence, ability and integrity.

- Tenure: Each Member holds office for a period of three years from the date of assumption of office.

What are the functions of NCM?

- Monitoring of the working of the safeguards for minorities provided in the Constitution and in laws enacted by Parliament and the state legislatures.

- Making recommendations for the effective implementation of safeguards for the protection of the interests of minorities by the central or state governments.

- Ensures that the Prime Minister’s 15-Point Programme for the Welfare of Minorities is implemented.

- Looking into specific complaints regarding deprivation of rights and safeguards of minorities and taking up such matters with the appropriate authorities.

- Investigates matters of communal conflict and riots.

News Source: TH

CSE Transparency Index

Part of: GS Prelims and GS- II – Governance

In news The Centre for Science and Environment (CSE), a Delhi-based non-profit, released the report ‘Transparency Index — Rating of Pollution Control Boards on Public Disclosure’.

About CSE Transparency Index-

- There are 28 state pollution control boards (SPCB) and 6 pollution control committees (PCC) in the country that make pollution information public on websites.

- CSE has released a report/index to assess the level of transparency maintained by these SPCBs and PCCs.

- This report critically evaluates the information shared by SPCBs/PCCs during the last four-five years (2016–21) and uses several indicators that provide a broader indication on the type and amount of information shared.

Key findings:

- Around 60% of the bodies scored less than 50% on the information disclosure parameters studied.

- Only 14 boards scored above 50% in the index.

- They are Odisha, Telangana, Tamil Nadu, Madhya Pradesh, West Bengal, Goa, Karnataka, Haryana, Chhattisgarh, Himachal Pradesh, Jammu and Kashmir, Kerala, Maharashtra, Uttarakhand, Punjab, Andhra Pradesh and Rajasthan.

- The index’s analysis cited that most agencies are not transparent enough with information in the public domain.

- Information on functioning, actions taken by boards against polluting industries, public hearing data on new projects etc are rarely disclosed, or are not even available on public websites.

- TOP PERFORMERS: Pollution control boards of Odisha and Telangana (67%).

- Tamil Nadu ranked a close second with 65.5% transparency,

- Madhya Pradesh ranked third (64%)

- West Bengal ranked fourth (62%)

- Goa ranked fifth (60.6%).

- Only five boards including Haryana have shared minutes of their board meetings on their websites.

- Only five SPCBs including Himachal Pradesh have shared information on inspections conducted by the boards.

News Source: Outlook

(News from PIB)

TAPAS Initiative

Part of: GS Prelims and GS – II – Education

In news Recently, the Ministry for Social Justice and Empowerment has launched an online portal TAPAS (Training for Augmenting Productivity and Services).

- The idea of TAPAS was conceptualised at a time when exploring the online medium for work and education had become imperative due to the outbreak of Covid 19 pandemic.

About the initiative

- It is an initiative of National Institute of Social Defense (NISD) whereby various courses in the field of social defence for the capacity building of stakeholders are offered.

- Objective: To impart training and enhance the knowledge and skills for the capacity building of the participants.

- It is a standard MOOC (Massive Open Online Course) platform with course material such as filmed lectures and e-study material.

- MOOC is a free Web-based distance learning program that is designed for the participation of large numbers of geographically dispersed students.

- It also includes discussion forums to support and encourage interactions among students and course coordinators.

- It will provide access to lectures by subject experts, study material and more, but in a manner that it supplements the physical classroom without compromising on the quality of teaching.

- It can be taken up by anyone who wishes to enhance his or her knowledge on the topics and there is no fee for joining.

- The platform has been made with a quadrant approach, which is: Video, Text, Self-Assessment and Discussions.

- Courses: The five basic courses are on Drug (Substance) Abuse Prevention, Geriatric/Elderly Care, Care and Management of Dementia, Transgender Issues and on comprehensive course on Social Defence Issues.

News Source: PIB

Centre Notifies RoDTEP Scheme Guidelines and Rates

Part of: GS Prelims and Mains GS-III- Economy

In news: Centre has recently notified RoDTEP Scheme Guidelines and Rates (Remission of Duties and Taxes on Exported Products).

- The rates of RoDTEP will cover 8555 tariff lines.

About Remission of Duties and Taxes on Exported Products (RoDTEP):

- The RoDTEP scheme was announced by Union Government in 2019 to boost exports by allowing reimbursement of taxes and duties, which are not exempted or refunded under any other scheme.

- At present, embedded duties and taxes, which are not refunded under any other scheme, range from 1-3%.

- Under the scheme, rebate of these taxes will be given in the form of duty credit/electronic scrip.

- It is a reform based on the globally accepted principle that taxes and duties should not be exported, and taxes and levies borne on the exported products should be either exempted or remitted to exporters.

- The scheme is in accordance with World Trade Organization (WTO) norms.

- It is a combination of the current Merchandise Export from India Scheme (MEIS) and Rebate of State and Central Taxes and Levies (RoSCTL).

- MEIS: It’s a scheme where incentives or rewards are given to exporters to offset infrastructural inefficiencies with the objective to promote manufacture and export of notified products

- RoSCTL: The scheme was notified by textile ministry to rebate the incidence of various state and central tax levied on export of garments.

Significance of the RoDTEP scheme:

- RoDTEP support will be available to eligible exporters at a notified rate as a percentage of Freight on Board (FOB) value. Rebate on certain export products will also be subject to value cap per unit of the exported product.

- Sectors like Marine, Agriculture, Leather, Gems & Jewellery, Automobile, Plastics, Electrical / Electronics, Machinery get the benefits of Scheme.

- In the existing schemes, certain taxes, such as state taxes on power, oil, water and education cess, are not included. Under RoDTEP, such taxes are also proposed to be included in the indicative list making the scheme exhaustive.

- Therefore, it is a reform where Government is trying to support domestic industry and make it more competitive in the international markets.

News Source: PIB

TRIFED adds 75 new tribal products to Tribes India catalogue

Part of: GS Prelims and Mains GS-III- Economy

In news: As India steps into 75 years of Independence, 75 new tribal products were launched by TRIFED and added to the already extensive, attractive Tribes India catalogue.

- Sourced from all across the country, the products launched exquisite and attractive items such as metal figurines, handmade jewelry, decorations such as hangings; handcrafted apparel such as shirts, kurtas, masks and also organic produce such as spices, processed juices and other herbal powders.

Key Highlights:

- TRIFED GI Movement, has also identified 75 products of Tribal origin or source which will be registered for Geographical Indication (GI) Tag under the Geographical Indications of Goods (Registration and Protection) Act, 1999, India.

- Out of 75 identified GI Tribal products, 37 such products belong to eight states of North East.

- From Tribal heartland states, 7 products from Jharkhand and 6 products from Madhya Pradesh have also been identified for GI Tagging.

- Moreover, it is about to set up an Atmanirbhar Bharat corner in 100 Indian Missions/ Embassies across the world that will be an exclusive space to promote GI tagged tribal art and craft products besides natural and organic products.

About The Tribal Cooperative Marketing Development Federation of India (TRIFED):

- Established in 1987, under the Multi-State Cooperative Societies Act, 1984, this statutory body works for the social and economic development of the tribal people of the country and is administered by the Ministry of Tribal Affairs.

- It has been registered as a National Level Cooperative body by the Government of the country

- It helps tribal people manufacture products for national and international markets on a sustainable basis and also supports the formation of Self-Help Groups and imparting training to them.

News Source: PIB

(Mains Focus)

INTERNATIONAL/ SECURITY

- GS-2: India and its neighborhood- relations.

- GS-2: Effect of policies and politics of developed and developing countries on India’s interests

The script of the new endgame in Afghanistan

Context: The departure of Afghanistan President Ashraf Ghani and almost the entire top political leadership of Afghanistan to safer havens, as Taliban has quickly captured Afghanistan.

US decision to withdraw its forces irrespective of the situation within Afghanistan — without any consideration of the consequences —enabled the Taliban to take over.

Issues

- The Taliban’s duplicity in projecting, at one level the image of a mature group during the Doha talks while at another, perpetuating violence of the most ferocious kind, is clearly evident as events unfold.

- Present situation is worse than in 1990 when USSR withdrew from Afghanistan. During 1990s there was at least a leader who could mobilize people against Taliban rule. Today, there is collapse of organised resistance both at domestic and international level to Taliban takeover.

- As the Afghan state implodes, one can expect a wider cleaving between Pashtuns, Uzbeks, Tajiks, Hazaras and the myriad other clans that populate Afghanistan.

- Radicalised Islamist terror and the forces of ‘doctrinaire theocracy’ have become stronger. The collapse of the Afghan state will ignite many old threats (resurgence of Al-Qaeda & ISIS)

- US exit without any responsibility has diminished the image of the U.S. in Asian eyes. In light of this, U.S. claims to ‘make America great again’ sound extremely hollow

- In Afghanistan, the Taliban is intent on keeping absolute control and is counting on China, Russia, and Pakistan to do so. All of them are more intent on keeping out the U.S., and in effect India.

Situation not in favour of India

- India may be the outlier among Afghanistan’s neighbours for a variety of reasons, including its warm relations with the Karzai and the Ghani regimes in the past two decades.

- For India, the virtual retreat of the U.S. from this part of Asia; the growing China-Russia-Pakistan nexus across the region; and an Iran under a hardliner like Ebrahim Raisi, all work to its disadvantage.

Conclusion

If the 21st century was expected to become the century of progress, the situation in Afghanistan represents a severe setback to all such hopes and expectations. The aftershock of the takeover of Afghanistan by the Taliban can be expected to continue for long.

Connecting the dots:

ECONOMY/ GOVERNANCE

- GS-2: Government policies and interventions for development in various sectors.

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Oil Bonds

In news: The Centre has argued that it cannot reduce taxes on petrol and diesel as it has to bear the burden of payments in lieu of oil bonds issued by the previous UPA government to subsidise fuel prices.

Brief Background

- Before fuel prices were deregulated, petrol and diesel as well as cooking gas and kerosene were sold at subsidised rates.

- Government would intervene in fixing the price at which retailers were to sell diesel or petrol. This led to under-recoveries for oil marketing companies, which the government had to compensate for.

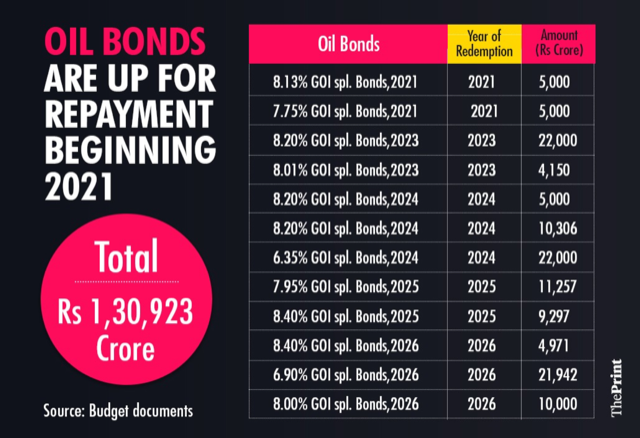

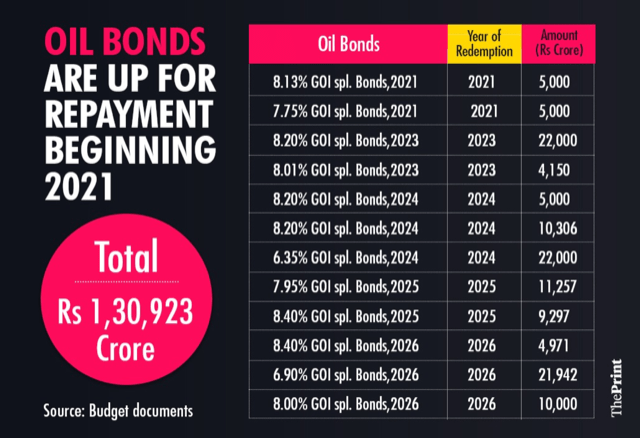

- Instead of paying direct subsidy to oil marketing companies from the Budget, the then government issued oil bonds totalling Rs 1.34 lakh crore to the state-fuel retailers in a bid to contain the fiscal deficit

What are Oil bonds?

- Oil bonds are special securities issued by the government to oil marketing companies in lieu of cash subsidy.

- These bonds are typically of a long-term tenure like 15-20 years and oil companies are paid interest.

- Budget documents show that such bonds will be up for redemption from 2021-2026

Why do governments issue such bonds?

- Compensation to companies through issuance of such bonds is typically used when the government is trying to delay the fiscal burden of such a payout to future years.

- Governments resort to such instruments when they are in danger of breaching the fiscal deficit target due to unforeseen circumstances that lead to a collapse in revenues or a surge in expenditure.

- These types of bonds are considered to be ‘below the line’ expenditure in the Union budget and do not have a bearing on that year’s fiscal deficit, but they do increase the government’s overall debt.

- However, interest payments and repayment of these bonds become a part of the fiscal deficit calculations in future years.

Is issuance of such special securities restricted to UPA era?

- Besides oil bonds, the UPA era also saw the issuance of fertiliser bonds from 2007 to compensate fertiliser companies for their losses due to the difference in the cost price and selling price.

- Over the years, the NDA government has issued bank recapitalisation bonds to specific public sector banks (PSBs) as it looked to meet the large capital requirements of these PSBs without allocating money from the budget.

- Since 2017-18, the government has infused more than Rs 2.5 lakh crore of recapitalisation bonds to banks and paid interest of more than Rs 20,000 crore over these three years.

Why were oil prices deregulated, and how has it impacted consumers?

- Fuel price decontrol has been a step-by-step exercise, with the government freeing up prices of aviation turbine fuel in 2002, petrol in 2010, and diesel in 2014.

- The prices were deregulated to make them market-linked, unburden the government from subsidising prices, and allow consumers to benefit from lower rates when global crude oil prices tumble.

- Price decontrol essentially offers fuel retailers such as Indian Oil, HPCL or BPCL the freedom to fix prices based on calculations of their own cost and profits.

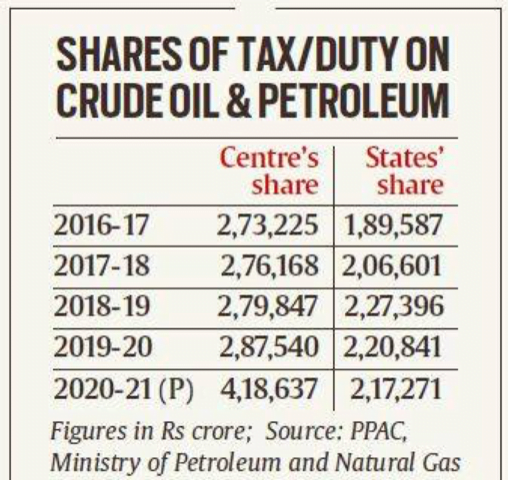

- However, the key beneficiary in this policy reform of price decontrol is the government.

Has Oil Price deregulation benefitted Consumers?

- While oil price deregulation was meant to be linked to global crude prices, Indian consumers have not benefited from a fall in global prices as the central as well as state governments impose fresh taxes and levies to raise extra revenues. This forces the consumer to either pay what she’s already paying, or even more.

Connecting the dots:

(RSTV Debate)

07th Aug 2021, The Big Picture – Investment positive: End of retro tax

https://www.youtube.com/watch?v=kAORdsQuImA

GOVERNANCE/ ECONOMY

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- GS-3: Indian Economy & Challenges

End of retro tax

In News: The Taxation Laws (Amendment) Bill, 2021 passed by Lok Sabha offers to drop tax claims against companies on deals before 28th May 2012 that involve indirect transfer of Indian assets on fulfilment of specified conditions including the withdrawal of pending litigation and the assurance that no claim for damages would be filed.

Background of the retrospective tax issue:

- In 2006-2007 Vodafone (British company) acquired Hutchison Essar (Indian telecom company), for $11 billion in Caymans Island.

- So, the deal did not take place in India and because the transaction took place offshore or outside the Indian jurisdiction, the companies didn’t make any provisions for capital gains tax.

- That September, when government noticed that to avoid the capital gain tax on the Indian property, such huge transaction was done offshore, India’s Income Tax Department served a notice on Vodafone for failing to deduct tax at source from the amount it paid to Hutchison in lieu of the capital gains tax it contended the seller Hutchison was liable for.

- The case went to court and in January 2012, India’s Supreme Court backed Vodafone, ruling that indirect transfer of shares to a non-Indian company would not attract tax in India.

- The supreme court also said that the current law doesn’t allow Indian government to levy capital gain tax on international transaction even when the underlying asset is located in India.

- In the Union Budget of 2012, the then Finance Minister, introduced retrospective amendment to the capital gain tax, which says that from any 1962 in or onwards, any capital gain that arise out of a transaction even if its international in nature, but if the asset is located in India, then the entities will have to provide for capital gain tax to the union government.

The Taxation Laws (Amendment) Bill 2021

- The Taxation Laws (Amendment) Bill, 2021 seeks to amend the Income-Tax Act, 1961, and the Finance Act, 2012 and withdraw contentious retrospective tax demand provision.

- It was introduced after India lost retrospective tax demand cases against Cairn Energy Plc. and Vodafone.

- The bill states that the demand had been raised in 17 cases and the retro tax was criticized for being against the principle of tax certainty and damaged India’s reputation as an attractive destination. It was a sore point for potential investors.

- The bill also states that any demand raised for “indirect transfer of Indian assets made before May 28, 2012, shall be nullified on fulfilment of specific conditions such as:

-

- Companies that have been served with notices in past will have to withdraw all legal cases if any filed against government of India

- Both Vodafone as well as CAIRN should withdrawal any cases and they shouldn’t expect to claim any damages for cost, damages, interest, etc. from government of India.

- For amicable settlement of disputes, the government will also refund amount paid in these cases without any interest.

- Earlier, Finance Secretary T V Somanathan had said a total of Rs 8,100 crore was collected using the retrospective tax legislation. Of this, Rs 7,900 crore was from Cairn Energy alone. This money will be repaid.

- If the companies will agree to these conditions, then the law will have a major impact.

Impact of the Taxation Laws (Amendment) Bill 2021

- Government sources said the move was meant to send a positive message to the investor community as it provides a reasonable opportunity to companies to resolve the issue.

- Apart from restoring India’s reputation as a fair and predictable regime, this will establish an investment-friendly business environment, which can increase economic activity and help raise more revenue over time for the government.

- It is a welcome move for foreign investors, and it will directly result in attracting more foreign investments by improving the ease of doing business.

- The move is expected to end litigation with 17 companies, including Vodafone and Cairn, apart from addressing criticism about uncertainty thus giving them a good opportunity to close all the past disputes and avoid future litigation costs.

Can you answer this question now?

“The Taxation Laws (Amendment) Bill 2021 will end litigation with 17 companies, including Vodafone and Cairn, apart from addressing criticism about uncertainty thus giving them a good opportunity to close all the past disputes and avoid future litigation costs”. Elucidate.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

Q.1 In the recently released report by The Centre for Science and Environment (CSE – ‘Transparency Index — Rating of Pollution Control Boards on Public Disclosure’, which of the following are the top performers?

- Odisha

- Telangana

- Jharkhand

Select the correct statements:

- 1 and 2 only

- 1 and 3 only

- 1 only

- 2 and 3 only

Q.2 Consider the following statements regarding National Commission for Minorities:

- Each Member holds office for a period of three years from the date of assumption of office.

- It became a quasi-judicial body in 1992, with the enactment of the NCM Act, 1992.

Which of the above is or are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 TAPAS initiative is launched by Which of the following Ministry?

- Ministry of Environment

- Ministry of Education

- Ministry of Finance

- Ministry of Social Justice and Empowerment

ANSWERS FOR 17th August 2021 TEST YOUR KNOWLEDGE (TYK)

Must Read

On Biotech Sector:

On Treaty on the Prohibition of Nuclear Weapons:

On Boosting electronics manufacturing:

[ad_2]