[ad_1]

Context:

Barely 11 months after the Government notified the Consumer Protection (E-Commerce) Rules, 2020, the Department of Consumer Affairs has mooted a set of sweeping amendments, ostensibly “to protect the interests of consumers and encourage free and fair competition in the market”.

According to the government argument, the proposed amendments aim to bring transparency in the e-commerce platforms and further strengthen the regulatory regime to curb the prevalent unfair trade practices.

Among them is a norm stipulating the appointment of a chief compliance officer, a nodal contact person for 24×7 coordination with law enforcement agencies, and another requiring e-commerce entities offering imported goods or services to ‘incorporate a filter mechanism to identify goods based on country of origin and suggest alternatives to ensure a fair opportunity to domestic goods’.

Background:

- For the purposes of preventing unfair trade practices in e-commerce, the Central Government had notified the Consumer Protection (E-Commerce) Rules, 2020 with effect from 23 July 2020.

- However, since the notification of these rules, the Government has received several representations from aggrieved consumers, traders and associations complaining against widespread cheating and unfair trade practices being observed in the e-commerce ecosystem.

- Prevalence of such unfortunate incidents has negatively impacted the consumer and business sentiment in the market, causing immense distress and anguish to many.

- It was observed that there was an evident lack of regulatory oversight in e-commerce which required some urgent action.

- Moreover, the rapid growth of e-commerce platforms has also brought into the purview the unfair trade practices of the marketplace e-commerce entities engaging in manipulating search result to promote certain sellers, preferential treatment to some sellers, indirectly operating the sellers on their platform, impinging the free choice of consumers, selling goods close to expiration etc.

Why need such an amendment?

- It was observed that there was an evident lack of regulatory oversight in e-commerce which required some urgent action.

- The rapid growth of e-commerce platforms has also brought into the purview the unfair trade practices of the marketplace e-commerce entities engaging in manipulating search result to promote certain sellers.

- This includes preferential treatment to some sellers, indirectly operating the sellers on their platform, impinging the free choice of consumers, selling goods close to expiration etc.

- Certain e-commerce entities are engaging in limiting consumer choice by indulging in “back to back” or “flash” sales.

- This prevents a level playing field and ultimately limits customer choice and increases prices.

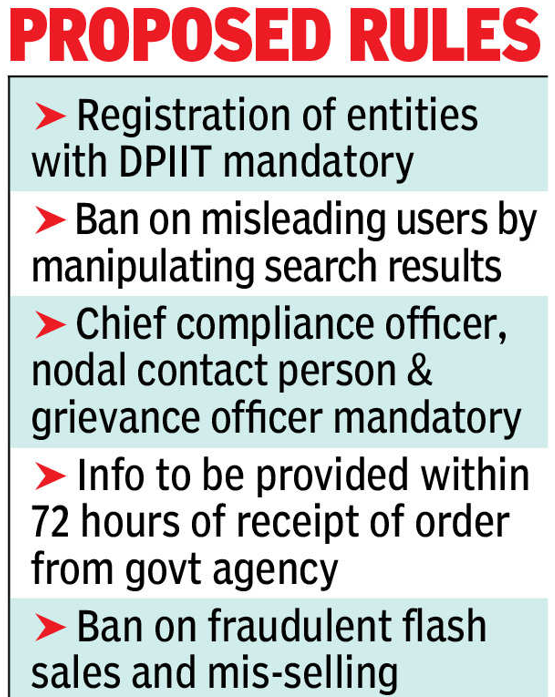

The proposed amendments are as follows:

- To ensure compliance of the Consumer Protection Act, 2019 and Rules, appointment of Chief Compliance Officer, a nodal contact person for 24×7 coordination with law enforcement agencies.

- Officers to ensure compliance to their orders and Resident Grievance Officer for redressing of the grievances of the consumers on the e-commerce platform, has been proposed.

- This would ensure effective compliance with the provisions of the Act and Rules and also strengthen the grievance redressal mechanism on e-commerce entities.

- Putting in place a framework for registration of every e-commerce entity with the Department for Promotion of Industry and Internal Trade (DPIIT) for allotment of registration number which shall be displayed prominently on website as well as invoice of every order placed the e-commerce entity.

- Registration of e-commerce entities would help create a database of genuine e-commerce entities and ensure that the consumers are able to verify the genuineness of an e-commerce entity before transacting through their platform.

- To protect the interests of consumers, mis-selling has been prohibitede selling goods and services entities selling goods or services by deliberate misrepresentation of information by such entities about such goods or services.

- To ensure that consumers are aware about the expiry date of the products they are buying on the e-commerce platform all sellers on marketplace e-commerce entities.

- All inventory e-commerce entities to provide best before or use before date to enable consumers to make an informed purchase decision.

- To ensure that the domestic manufacturers and suppliers get a fair and equal treatment on the e-commerce platform it has been provided that where an e-commerce entity offers imported goods or services, it shall incorporate a filter mechanism to identify goods based on country of origin and suggest alternatives to ensure fair opportunity to domestic goods.

- To ensure that consumers are not adversely affected in the event where a seller fails to deliver the goods or services due to negligent conduct by such seller in fulfilling the duties and liabilities in the manner as prescribed by the marketplace e-commerce entity, provisions of Fall-back liability for every marketplace e-commerce entity have been provided.

Government Initiatives regarding e-commerce sector:

- FDI guidelines for e-commerce by DIPP: In order to increase the participation of foreign players in the e-commerce field, the Government has increased the limit of foreign direct investment (FDI) in the e-commerce marketplace model for up to 100% (in B2B models).

- Government e-Marketplace (GeM) signed a Memorandum of Understanding (MoU) with Union Bank of India to facilitate a cashless, paperless and transparent payment system for an array of services in October 2019.

- The Department of Commerce initiated an exercise and established a Think Tank on ‘Framework for National Policy on e-Commerce’ and a Task Force under it to deliberate on the challenges confronting India in the arena of the digital economy and electronic commerce (e-commerce).

- The Reserve Bank of India (RBI) has decided to allow “interoperability” among Prepaid Payment Instruments (PPIs) such as digital wallets, prepaid cash coupons and prepaid telephone top-up cards.

- RBI has also instructed banks and companies to make all know-your-customer (KYC)-compliant prepaid payment instruments (PPIs), like mobile wallets, interoperable amongst themselves via Unified Payments Interface (UPI).

Conclusion:

The enforcement of many of these norms is bound to spur protracted legal fights.

Asserting that the amendments were not aimed at conventional flash sales, the Government said it was only targeting certain entities engaged in limiting consumer choice by indulging in ‘back-to-back’ sales wherein a seller does not have the capability to meet an order.

In trying to address shortcomings in its rules from last year, the Government appears to be harking back to an era of tight controls.

Overregulation with scope for interpretative ambiguity risks retarding growth and job creation in the hitherto expanding e-commerce sector.

[ad_2]